Multiply Your Success Podcast

Multiply Your Success Podcast

Are you looking to make big money in franchising? And maybe hoping to grow your franchise company to exit to a private equity or venture capital group eventually? This discussion is for franchisors who wish to someday successfully exit.

PE May Soon Tap Retail Retirement Investors - But Where is Capital Actually Needed?

PE May Soon Tap Retail Retirement Investors - But Where is Capital Actually Needed?

Private equity may soon be able to tap retirement funds at some level, something PE has long lobbied for. While this may open significant new capital sources to PE investing, there is already an estimated $2 trillion of PE committed funds that need to be deployed. Pouring billions of new dollars into mega deals backed with debt will surely open new opportunities (and new risks) for retail investors. But what we really need are more private capital investors active in the micro and lower-middle market who are adept at this type of investing and who take an operational approach (versus financial engineering). According to the U.S. Census Bureau 2022 Annual Business Survey, 52.3% of business owners are 55 or older. Small business remains a critical economic engine in this country, but we don’t have enough hands-on investment practitioners able to accomplish the lift to help smaller businesses reach the next level. More focus here would unlock significant economic growth and create needed liquidity events for retiring Main Street founders and franchisees. We see this dynamic in the franchise sector, which has been successfully picked over by private equity. Fewer than 20 percent of active franchises have PE investment. Mega franchise deals by the likes of #KKR, #Bain, and #Blackstone are exciting to see, and I also expect to see a surge of #franchise re-trading in 2025-2026 as long-held assets come due to trade again. Consolidation in scale systems will also continue as structural forces nearly guarantee this activity. But what we need are more skilled investors, incubators, and capital pointed at smaller franchise deals. We need to move the needle for thousands sub-scale or sub-optimized franchise systems that are actively marketing their franchise opportunity to prospective franchisees but are currently unlikely to attract PE growth capital and strategic support even if they want it. Smaller systems are where the hard work needs to be done to protect franchisee outcomes, build critical support and infrastructure, and create growth opportunities. If PE succeeds in opening the retirement fund spigot, those funds will be mostly pointed at mega PE firms. We need a mechanism for smaller firms to tap that opportunity so they can deploy more growth capital into smaller businesses. I’d like to see more mega PE sponsor or create fund of funds pointed at active micro and LMM investors.

Franchise Leaders Forum Podcast: Navigating Franchise Exit Strategies & Private Equity

Franchise Leaders Forum Podcast: Navigating Franchise Exit Strategies & Private Equity

Have you wondered how private equity can transform your franchising journey or why timing your exit strategy is as critical as choosing the right franchise? This discussion shares some golden nuggets on scaling your franchise, understanding private equity’s role and most importantly, planning your exit strategy ahead of time. So, if you are ready to uncover the secrets to scaling, sustaining and successfully exiting your business as well as learning about the financial intricacies of franchising that could be the game-changer for your business then today’s episode is for you! Episode Highlights: • Importance of private equity • Understanding what qualities private equities look for • Have a plan and an exit strategy ready • Financial preparedness and financial challenges • Strategic focus on exit strategies and private equity roles • Viewing a business from a buyer’s perspective • Importance of business valuation • Preparing a business for sale • Strategies for emerging brands when selling • Role of advisors in franchising

Franchisees Have Influence Ahead of a Sale Process

Franchisees Have Influence Ahead of a Sale Process

If there are issues that need to be addressed, franchisees should be crisp and smart about your "ask." Get organized. Establish the precedent that franchisees can make themselves heard at the boardroom level. Do this well ahead of a sale process for maximum impact.

Acquiring Minds - Podcast Interview

Acquiring Minds - Podcast Interview

Discussion of “acquisition entrepreneurship” in franchising – using the buy and build strategy rather than starting from scratch within the franchise model. It's important to think carefully through your objectives, exit strategy, and the impact of private equity.

Crunch Fitness Reportedly For Sale, TPG Looking For $1.5B

Crunch Fitness Reportedly For Sale, TPG Looking For $1.5B

Crunch is up for sale, TPG is reportedly looking for at least $1.5B (15x). Fitness continues to be an area of steady private equity interest at both the franchisor and franchisee level.

Wingstop Announces $500M Securitization

Wingstop Announces $500M Securitization

Investors (private equity and also pensions, university endowments, sovereign wealth funds, etc.) also buy into franchise businesses on the debt side. For example, publicly traded #wingstop recently announced a $500 million whole business securitization. According to Global Capital it was 8x oversubscribed. Franchising's impact on our economy is bigger than most people realize and its tentacles reach broadly across various stakeholders.

Jersey Mike's Sold To Blackstone for $8B

Jersey Mike's Sold To Blackstone for $8B

When you build a more valuable business FOR YOUR FRANCHISEES you win at exit. ..."only" 3,000 locations, $1.3M AUV, sold for $8B. Compare that to Subway with AUVs less than half JM's performance, 36,500 locations, sold for $9.6B. JerseyMikes continues to crush it. Now Blackstone simply needs to avoid messing up a great business.

Tropical Smoothie Has a New CEO

Tropical Smoothie Has a New CEO

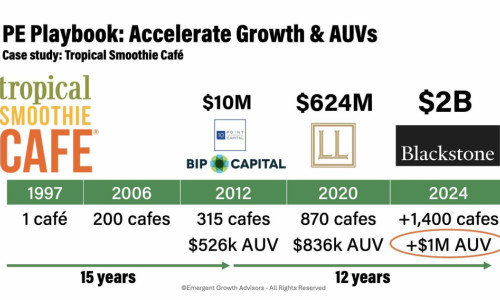

The Tropical Smoothie Cafe case study appears in Big Money in Franchising because it shows what can be accomplished when a management team and PE sponsors both put franchisee outcomes and a great culture first. Charles Watson, CFE has had an incredible 16 year run @ TSC, the last 6 as CEO. These are big shoes for the new incoming CEO to fill.

Popular Insights

As Seen In

PE Profit Ladder® Market Watch Newsletter

PRIVATE EQUITY’S IMPACT ON FRANCHISING

EMERGING BRANDS

TRENDS

BUILDING SMART

PROSPECTIVE FRANCHISEES

TURNAROUNDS & CASE STUDIES