Franchise Leaders Forum Podcast: Navigating Franchise Exit Strategies & Private Equity

Franchise Leaders Forum Podcast: Navigating Franchise Exit Strategies & Private Equity

Have you wondered how private equity can transform your franchising journey or why timing your exit strategy is as critical as choosing the right franchise? This discussion shares some golden nuggets on scaling your franchise, understanding private equity’s role and most importantly, planning your exit strategy ahead of time. So, if you are ready to uncover the secrets to scaling, sustaining and successfully exiting your business as well as learning about the financial intricacies of franchising that could be the game-changer for your business then today’s episode is for you! Episode Highlights: • Importance of private equity • Understanding what qualities private equities look for • Have a plan and an exit strategy ready • Financial preparedness and financial challenges • Strategic focus on exit strategies and private equity roles • Viewing a business from a buyer’s perspective • Importance of business valuation • Preparing a business for sale • Strategies for emerging brands when selling • Role of advisors in franchising

Franchisees Have Influence Ahead of a Sale Process

Franchisees Have Influence Ahead of a Sale Process

If there are issues that need to be addressed, franchisees should be crisp and smart about your "ask." Get organized. Establish the precedent that franchisees can make themselves heard at the boardroom level. Do this well ahead of a sale process for maximum impact.

Acquiring Minds - Podcast Interview

Acquiring Minds - Podcast Interview

Discussion of “acquisition entrepreneurship” in franchising – using the buy and build strategy rather than starting from scratch within the franchise model. It's important to think carefully through your objectives, exit strategy, and the impact of private equity.

Wingstop Announces $500M Securitization

Wingstop Announces $500M Securitization

Investors (private equity and also pensions, university endowments, sovereign wealth funds, etc.) also buy into franchise businesses on the debt side. For example, publicly traded #wingstop recently announced a $500 million whole business securitization. According to Global Capital it was 8x oversubscribed. Franchising's impact on our economy is bigger than most people realize and its tentacles reach broadly across various stakeholders.

Jersey Mike's Sold To Blackstone for $8B

Jersey Mike's Sold To Blackstone for $8B

When you build a more valuable business FOR YOUR FRANCHISEES you win at exit. ..."only" 3,000 locations, $1.3M AUV, sold for $8B. Compare that to Subway with AUVs less than half JM's performance, 36,500 locations, sold for $9.6B. JerseyMikes continues to crush it. Now Blackstone simply needs to avoid messing up a great business.

Tropical Smoothie Has a New CEO

Tropical Smoothie Has a New CEO

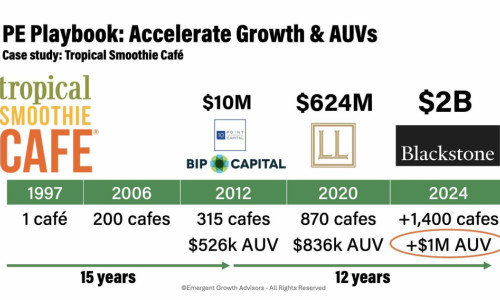

The Tropical Smoothie Cafe case study appears in Big Money in Franchising because it shows what can be accomplished when a management team and PE sponsors both put franchisee outcomes and a great culture first. Charles Watson, CFE has had an incredible 16 year run @ TSC, the last 6 as CEO. These are big shoes for the new incoming CEO to fill.

Entreye Podcast Interview

Entreye Podcast Interview

Themes from this podcast: ▶ State of franchise brands in the US ▶ Private Equity's Value in Franchising ▶ When is the best time to attract PE investment ▶ Best way for brands to prep for PE, and things to avoid ▶ Reg flags PE looks for in Franchise brands ▶ PE's on the franchise development pipeline ▶ PE's interest in unglamorous industries ▶PE's role in enhancing value through platforming

Looking Ahead to 2025, Remember Franchise Ownership is Personal

Looking Ahead to 2025, Remember Franchise Ownership is Personal

Looking Ahead to 2025, Remember Franchise Ownership is Personal

Consider These Points When Selling Franchises During A Contentious Election Season

Consider These Points When Selling Franchises During A Contentious Election Season

"Election jitters" can negatively impact the franchise development process. If your franchise sales have stalled, or you're suddenly hearing "We're going to wait" from prospective franchisees, here are tips to reboot growth.

Popular Insights

As Seen In

PE Profit Ladder® Market Watch Newsletter

PRIVATE EQUITY’S IMPACT ON FRANCHISING

EMERGING BRANDS

TRENDS

BUILDING SMART

PROSPECTIVE FRANCHISEES

TURNAROUNDS & CASE STUDIES